#CASH FLOW FROM FINANCIAL ACTIVITIES SOFTWARE#

Pay your employees and keep accurate books with Payroll software integrationsįreshBooks integrates with over 100 partners to help you simplify your workflows Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one place Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Time-saving all-in-one bookkeeping that your business can count on Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again

Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready

Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

#CASH FLOW FROM FINANCIAL ACTIVITIES PROFESSIONAL#

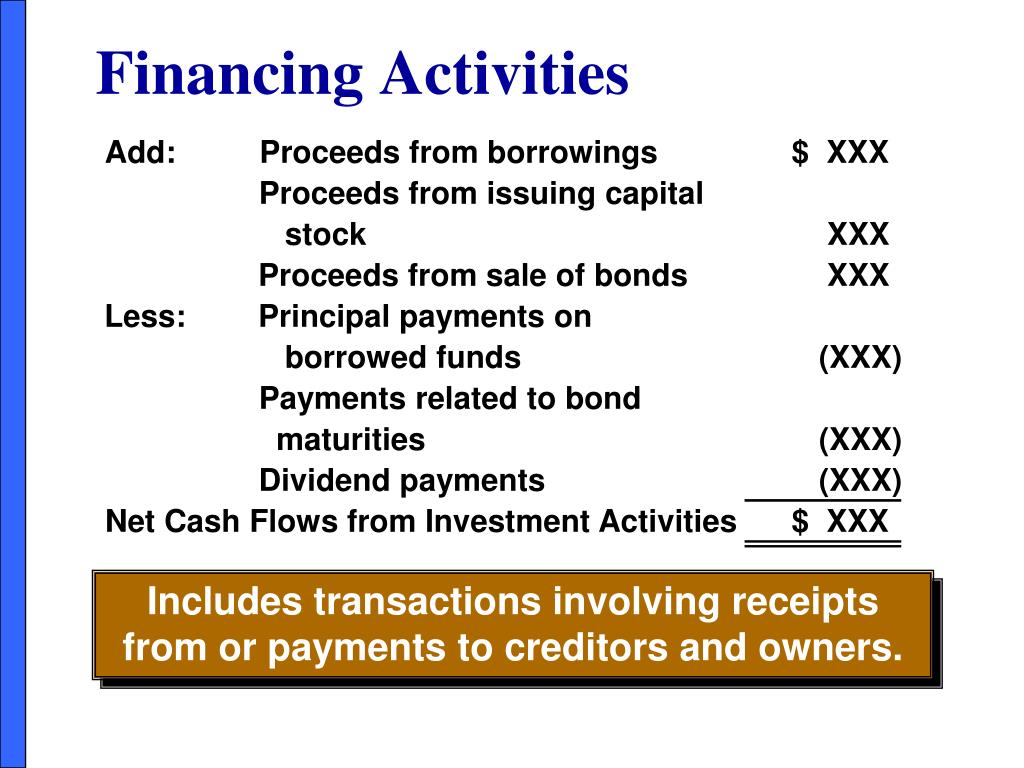

The second cash outflow is an investing activity since it is related to the acquisition of a long-term asset.Wow clients with professional invoices that take seconds to create This is because it is related to the production activities of the company. The first cash outflow is an operating activity. Operating cash flow and investing cash flow.Investing cash flow and operating cash flow.How would you classify the cash flow related to paying for shipping expenses of product materials and a new production machine, respectively? Proceeds from the sale of machinery is an example of cash derived from an investing activity.Ī is incorrect because proceeds from the issuance of bonds relate to a financing activity.Ĭ is incorrect because the sale of inventory is an operating activity. Cash received from the sale of inventory.Which of the following would be classified as a cash flow from investing activity? Cash inflows would arise from the issuance of stock or bonds and borrowing, while cash outflows would include cash payments for repurchasing stock and repaying bonds or other borrowings. Cash Flow from Financing Activities: this provides information on cash flows that are derived from acquiring or repaying capital.Such ventures include the purchase or sale of property, plant, and equipment, intangible assets, and investments in the debt and equity issued by other companies and Cash Flow from Investing Activities: this provides information on cash flows that are derived from the purchase and sale of long-term assets and other investments.Further, cash flows from operating activities also include cash receipts and payments arising from dealing or trading in securities (not for investment purposes) Among others, these cash flows include proceeds from the sale of inventory, and from the provision of services or other activities that are not related to financing or investing. Cash Flow from Operating Activities: this provides information on cash flows that are derived from the day-to-day activities of a company.There are three components of the Cash Flow Statement: This information can help users of financial statements (creditors, investors, analysts, etc.) evaluate a company’s liquidity and solvency. The cash flow statement gives information on a company’s cash receipts and payments during a specified period of time.

0 kommentar(er)

0 kommentar(er)